Analysts predict that the period of astonishing palladium rises is coming to an end. Increased supply and stagnant demand drive down the price of the metal. Palladium is used to reduce automobile exhaust emissions.

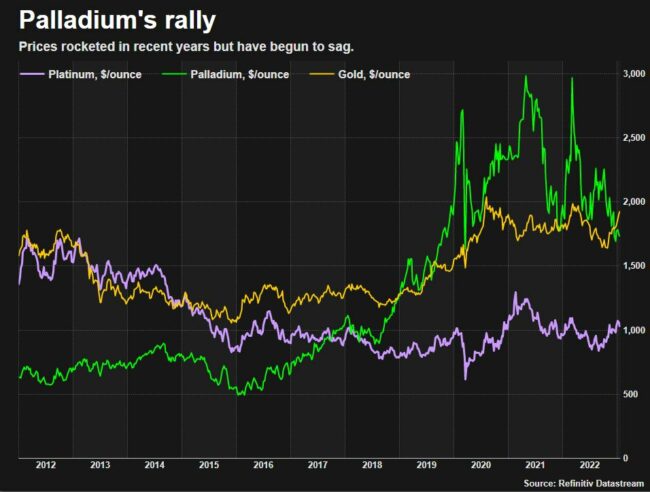

Palladium, previously the least expensive of the major precious metals, saw an unprecedented surge in its prices over the past few years. Starting from less than $500 per ounce back in 2016, it skyrocketed to almost $3,400 this March and left platinum and gold far behind.

Surging demand from major automakers who wanted more palladium per vehicle to comply with stringent pollution regulations set by governments worldwide has led to a surge in the demand for palladium. This caused significant deficits due to the lack of supply, however, current trends indicate this is currently changing.

Automakers are replacing palladium

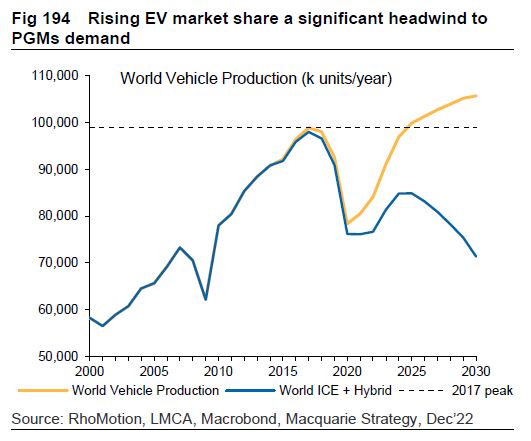

Automakers are increasingly replacing some of the more expensive and rare palladium in combustion engine vehicles with platinum, a less expensive alternative, as electric vehicles (EVs) that do not require the use of palladium begin to gain more widespread market dominance. This shift is helping to lower the cost of production for traditional vehicle manufacturers who are looking to remain competitive in an ever-evolving automotive industry.

With the increasing number of palladium-containing vehicles nearing the end of their useful lives, the recycled vehicle supply is growing exponentially, presenting a great opportunity for businesses to obtain cost-effective and sustainable resources for use in their operations. Recycled vehicle supply offers a viable solution to reduce environmental impact, save money, and support circular economy initiatives.

Palladium has decreased in price to about $1,700 per ounce.

Analysts say: Palladium price will fall more

Every year, prices are gradually declining, according to Bank of America analyst Michael Widmer. This metal only has one useful skill. Almost 90% of demand is based on the auto sector.

In 2027, prices, according to Macquarie analysts, will be on average only $1,150 per ounce.

According to Morgan Stanley analysts, between 2022 and 2027, demand from manufacturers would decline by about 400,000 ounces while supply from recycling vehicles will rise by 1.2 million ounces.

They predict this will result in a surplus of around a million ounces in the roughly 11 million ounces per year market by 2027.

In the foreseeable future, they expected that large surpluses will be able to offset large deficits, but it is still too early to conclusively state that we have eliminated any short-term rising trends in the market. Nevertheless, the accumulated data from recent years suggest that certain paths taken by governments and businesses in tackling these issues are showing promising results.

Macquarie predicts increased demand from automobiles this year and the following year, with no palladium excess before 2025.

Uncertainty will persist as long as the war in Ukraine lasts

Norilsk Nickel, a Russian company that produces 40% of the world’s mined palladium, announced on Tuesday that this year’s output would decline by 8% to 14%, potentially tightening the market.

Due to concerns about sanctions against Norilsk’s palladium following Russia’s invasion of Ukraine, prices spiked last year. According to Jacob Smith of consultancies Metals Focus, supply chain uncertainty will persist as long as the war lasts.

He said we would undoubtedly observe a jump if there are any restrictions on this metal supply from Russia.