While the world is concerned about the issue of climate change and the green transition, the technology industry is already experiencing genuine difficulties with supplying rare earth metals such as nickel, palladium, and neon, without which the digital economy is unthinkable.

China was the first to orient itself in this matter, having established production and purchases. In this case, it is pretty appropriate to assert that the metals of the energy transition are in the hands of China.

The global technology industry is under threat. In particular, Europe directly depends on the supply of nickel, palladium, and neon from Russia and Ukraine.

Now, these supplies are under the same question as gas and oil, which are embargoed. Interruptions in the supply of rare metals can also be called an alarming sign.

With a shortage of rare elements, the transition to renewable energy sources is highly questionable. In addition, the current situation with Ukraine practically frustrates the European Union’s plans to achieve zero carbon emissions. At least in the short and medium term, this is not feasible.

The current situation hinders the decarbonization plans not only for Europe but also for America. In particular, the US cannot switch to its own production – the worst forecasts came true after another self-isolation of China due to Covid-19.

Even though now all attention is focused on the Russian-Ukrainian conflict, the lack of raw materials and rare earth metals for new technologies was felt back in 2020. In addition, environmental requirements for its extraction and processing have increased.

According to Vicente Gutierrez, Secretary General of the Spanish Mining Confederation, geostrategy now resembles chaos theory. As soon as a butterfly flaps its wings in Beijing, a hurricane will pass in America. This is exactly what is happening now with nickel, palladium and neon.

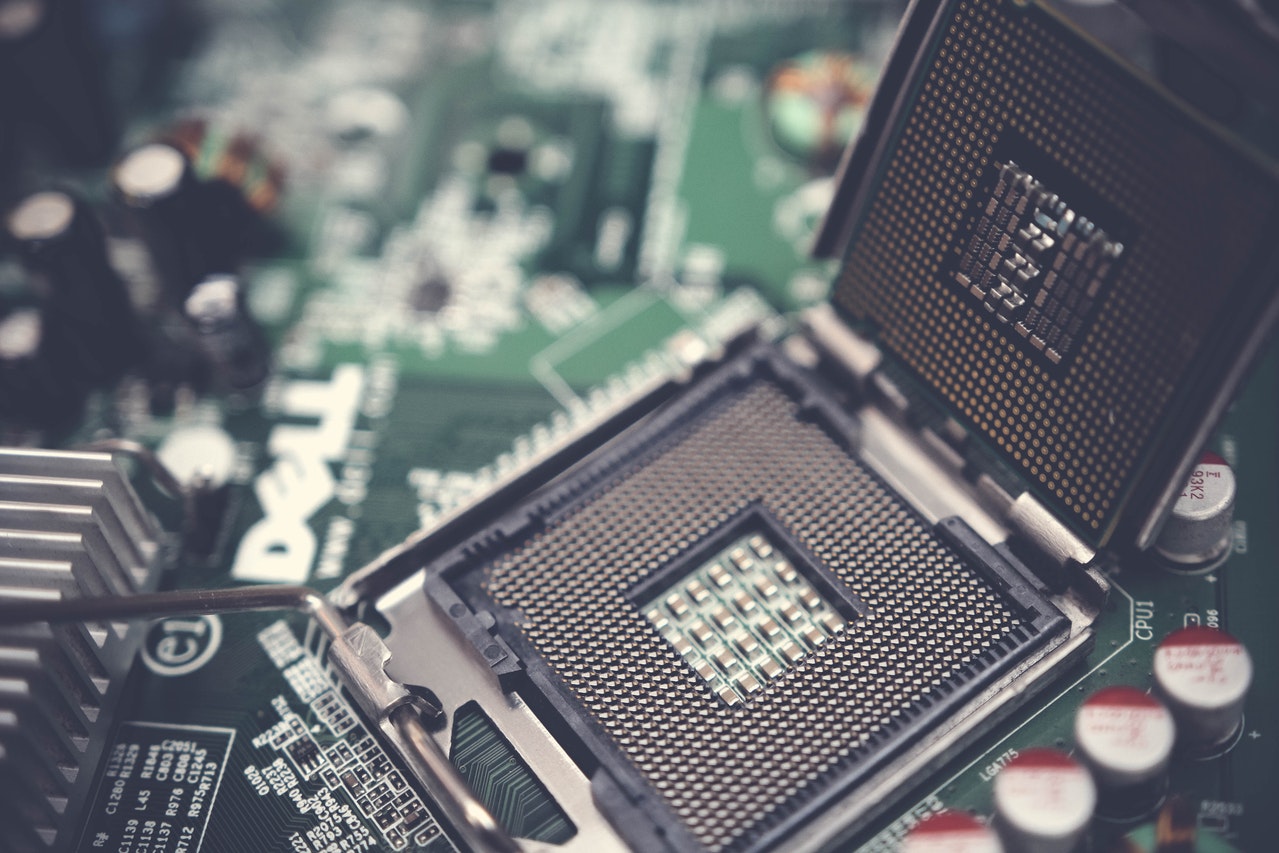

Half of the world’s neon supplies came from Ukraine, in the form of lasers and semiconductors. From here it is exported to the US, Japan and South Korea.

While Russia accounts for 43% of the world’s palladium reserves exports, the country also holds third place in the world in producing high-quality nickel. Clearly, nickel in all respects, is the mineral of the future, and the price and demand for it will only grow.

According to experts, in the next 20 years it will be possible to earn no less on nickel than once on oil, and it is possible that demand for nickel could shift to Canada, Latin America, and Australia.