A trustworthy pan-African provider of competitive, full-service renewable energy and energy efficiency solutions to the continent’s commercial and industrial (C&I) sectors, Starsight Energy and SolarAfrica Energy’s combined strength this fall thanks to AIIM. This way, they are becoming one of the continent’s most dominating solar businesses.

African Infrastructure Investment Managers (AIIM) made again this significant additional equity and preference share investment. It is one of Africa’s largest infrastructure-focused private equity fund managers.

In the next three years, AIIM promised to boost its pipeline of renewable energy investments in South Africa from 2,000MW to 5,000MW. Along with its initial investment in Starsight Energy, which was disclosed in 2018, AIIM has now committed an additional $73 million in stock and shareholder finance to the merged entity’s South African subsidiary. This would hasten the construction of the contracted pipeline in the South African C&I wheeling market, giving large C&I customers access to green energy and price certainty.

AIIM’s support for this merger underlines their faith in the all-growing potential of full-service renewable energy companies in Africa. AIIM announced this is a turning point for modern, clean energy across the continent and a huge advancement in Africa’s energy transformation.

Boosting solar energy as a commitment

AIIM contributes significantly to the platform’s development over the past five years with a renewable energy portfolio of about 2GW and a position as one of Africa’s top equity investors in the sector. The merged company should increase the supply of dependable solar energy. Additional equity and loan finance is by AIIM’s IDEAS Infrastructure I Partnership. African Infrastructure Investment Managers said they will gladly continue to support this expansion.

The deal must receive all necessary regulatory clearances, including antitrust approvals. Once approved, the combined company will have a portfolio of more than 220MW of operated and contracted generation capacity. Also, they’ll have 40MWh of operational battery storage. It will have a pipeline of additional generation capacity that exceeds 1GW. The pipeline spans three important geographic hubs: Southern, East, and West Africa.

They positioned the merged company to contribute to solving South Africa’s current load-shedding issues. There are still regular blackouts across the country. SolarAfrica is already a significant provider of energy in South Africa but will grow further in the future. That means constructing new utility-scale generation facilities and wheeling electricity over the country’s existing power grid. The result should be bringing cost savings, carbon reduction, and power security to its commercial and industrial customers.

What is AIIM and what do they do in renewable business?

The enterprise mentioned above is neither the first nor will be the last AIIM enterprise. Renewable solar energy is one of their missions to power and empowers Africa.

African Infrastructure Investment Managers (AIIM) is a private equity infrastructure investment company. It finances a variety of projects across Africa. The projects encompass different fields, and one of them is renewable energy.

Among other projects not connected to renewables is the construction of gas pipelines, roads, ports, and communication infrastructure. But the generation and transmission of thermal and renewable power seem to be the most important now.

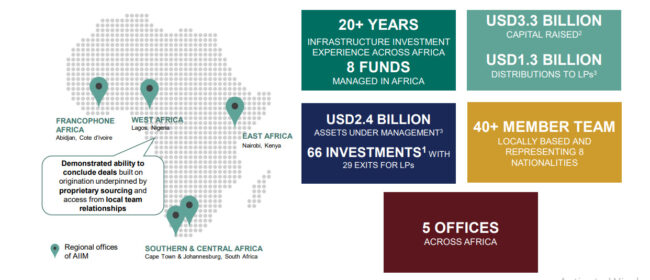

One of the biggest and most established African infrastructure fund managers, AIIM has been making investments throughout the continent for almost two decades.

With six infrastructure funds totaling $1.9 billion and four regional offices in Cape Town, Johannesburg, Lagos, and Nairobi, AIIM delivers value to infrastructure investment activities. They invest across Sub-Saharan Africa with their strategic, commercial, operational, and financial experience.

Why did they choose to merge Starsight Energy and SolarAfrica?

Merging SolarAfrica and Starsight Energy is a good move not only for the business but for the people of Africa too.

First, commercial and industrial clients in Africa get the best clean on-grid and off-grid energy services from Starsight Energy. Starsight Energy provides tailored power and cooling solutions minimizing consumption through energy-efficient appliances and environmentally friendly practices. The company serves the commercial and industrial, financial, residential, educational, and agricultural sectors.

On the other side, the commercial and industrial sectors in Southern Africa can benefit from a range of green energy solutions. The green energy solutions come from solar and battery storage to electricity trading and wheeling provided by SolarAfrica. The company takes customers on a green energy journey that enables them to secure 100% of their energy needs offline. SolarAfrica resolves the continuous power struggles in Africa. The company’s mission is to create a sustainable future for businesses by providing energy solutions that enable cost savings, carbon reduction, and power security.

Could it be better for all?