The global car industry has invested $1.2 trillion in EV (electric vehicle) research, providing new startups with a fantastic opportunity to land contracts for everything from battery packs to motors and inverters.

Competition for EV contracts has included startups that specialize in batteries and coatings to protect EV parts, as well as suppliers who have typically catered to the Formula One (F1) racing sector or specialized motorsports. They make automobile platforms to endure ten years, enabling high-volume models to make sizable profits for many years.

Expecting the new EV generation

In or around 2025, they expect the next generation of EVs to be introduced. In order to fill knowledge shortages, many manufacturers have requested assistance, which has created a window of opportunity for new providers.

As Nick Fry, CEO of F1 engineering and technology company McLaren says, the auto industry is going back to the days of Henry Ford when everyone was wondering how they make these ”things” operate properly. He adds that this is a fantastic opportunity for small businesses.

Inverters are the first thing startups can make for the new EV generation

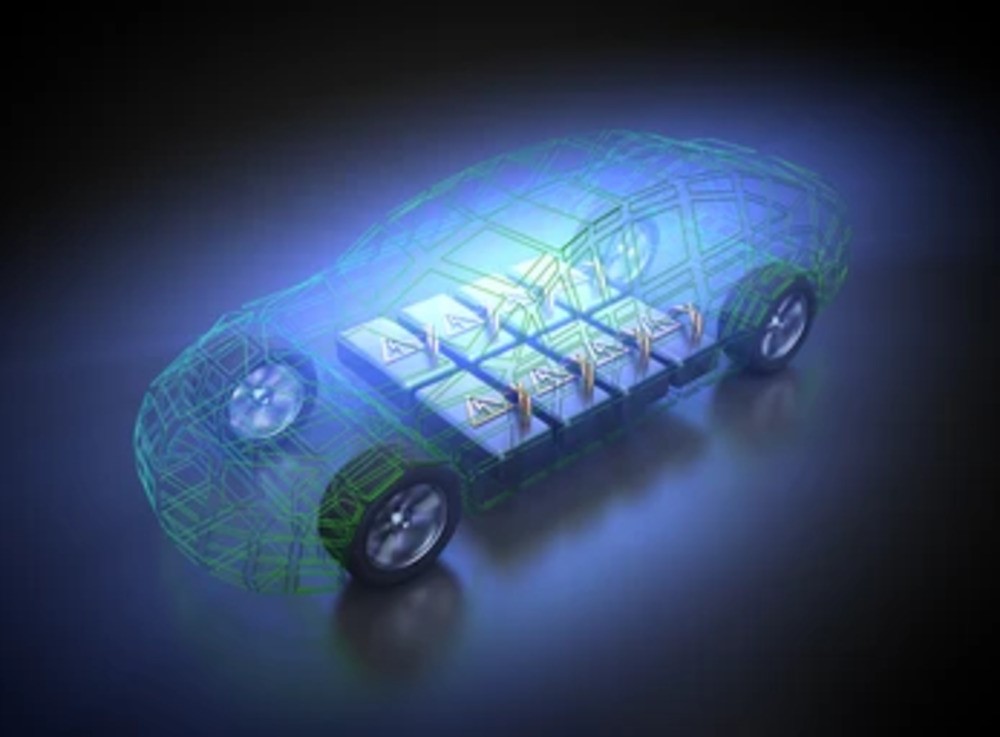

In 2021, McLaren Applied was acquired by the private equity firm Greybull Capital, and McLaren Applied repurposed an efficient inverter designed for F1 racing for electric vehicles. An inverter can be used to control the flow of electricity to and from the battery pack.

The 5.5 kilogram silicon carbide IPG5 inverter can increase an EV’s range by more than 7%. According to Fry, high-volume premium EV cars will include the inverter starting in January 2025 thanks to a partnership between McLaren Applied and roughly 20 automakers and suppliers.

Large-scale automakers cautious after pandemic parts shortages

Large-scale automakers frequently want to own the technology and produce EV components internally. They are cautious about relying too heavily on suppliers after years of pandemic-related parts shortages.

Tim Slatter, head of Ford in Britain, stated that the big companies simply cannot afford to rely on outside parties to make those investments on their behalf.

Traditional suppliers are also making significant investments in EVs and other technologies. They need to stay ahead in a sector that is changing quickly, including German powerhouses Bosch and Continental.

Smaller businesses hoping that there are still chances

However, smaller businesses claim that there are still chances, particularly for low-volume producers who cannot afford to make significant EV investments or for luxury and high-performance automakers looking for a competitive advantage.

Starting this year, an unnamed German carmaker will produce a high-performance model with an annual production of about 40,000 units using a Rimac battery system. Rimac is a Croatian electric hypercar manufacturer that also provides battery systems and powertrain components to other automakers. Germany’s Porsche AG partially owns it. They also work on more agreements.

According to its CEO Mate Rimac, startups must do 20% to 30% better than they can before big companies cooperate with them. If the big ones can produce a battery pack with a capacity of 100 kilowatt hours, small companies must do so with a 130 kilowatt capacity at the same price.

What do the startups do?

Some vendors, including Cambridge, Massachusetts-based Actnano, have a history of working with the inventor of the electric vehicle, Tesla. Actnano has created a coating to prevent condensation on electric vehicle (EV) components, and its business has expanded to include advanced driver-assistance systems (ADAS) and other automakers like Volvo, Ford, BMW, and Porsche.

A totally automated, flat, and simple-to-install “flex harness” is a production of California-based startup CelLink in place of a wire harness to a group and direct cables in a vehicle. CelLink’s CEO Kevin Coakley said the company’s harnesses are into almost a million EVs but did not name specific clients. That scale is unique to Tesla.

CelLink was collaborating on battery wiring with U.S., Europe, and a European battery manufacturer.

Others, like the UK firm Ionetic, concentrate on low-volume producers and create battery packs that are too expensive for smaller businesses to build themselves.

Currently, electrification is simply too expensive, which is why some manufacturers are delaying the introduction of electrification.